The Payment Solution Tailored For Your Business

Growing a business can be challenging, but we’re here to support you. Lemonade provides fast and secure payment processing for businesses of all sizes and industries, including retail, e-commerce, marketing, hospitality, travel, consulting, and more.

Zero complexity, Seamless execution

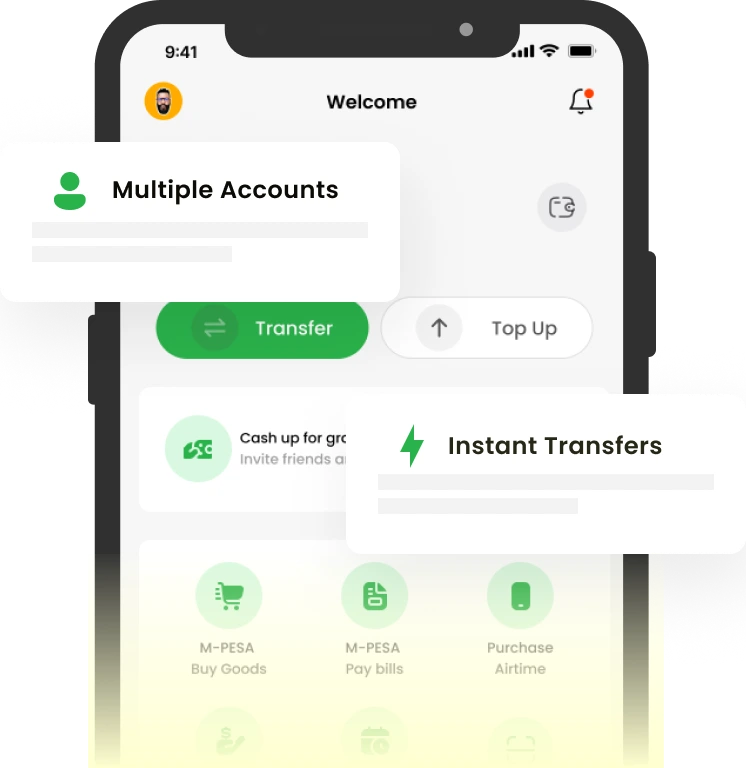

Smooth onboarding process and rapid turnaround in executing our first bulk settlement. Platform handled salary

disbursements flawlessly with multiple transfers options (bank transfers, mobile money).

Henry Ohanga

Founder at Code Particles

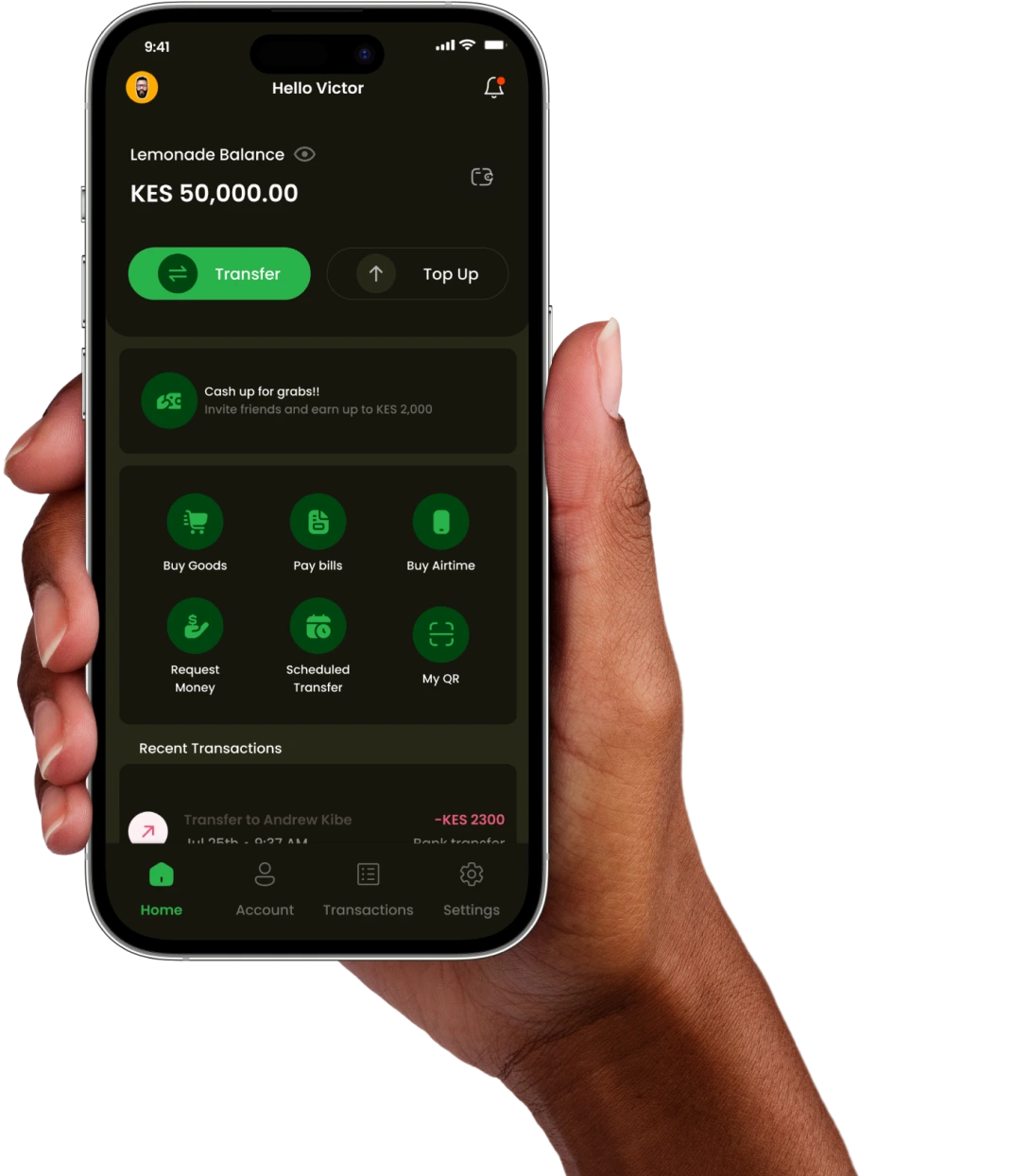

Instant, Secure Payments Made Effortless

Experience fast, secure, and private transactions with minimal transfer fees.

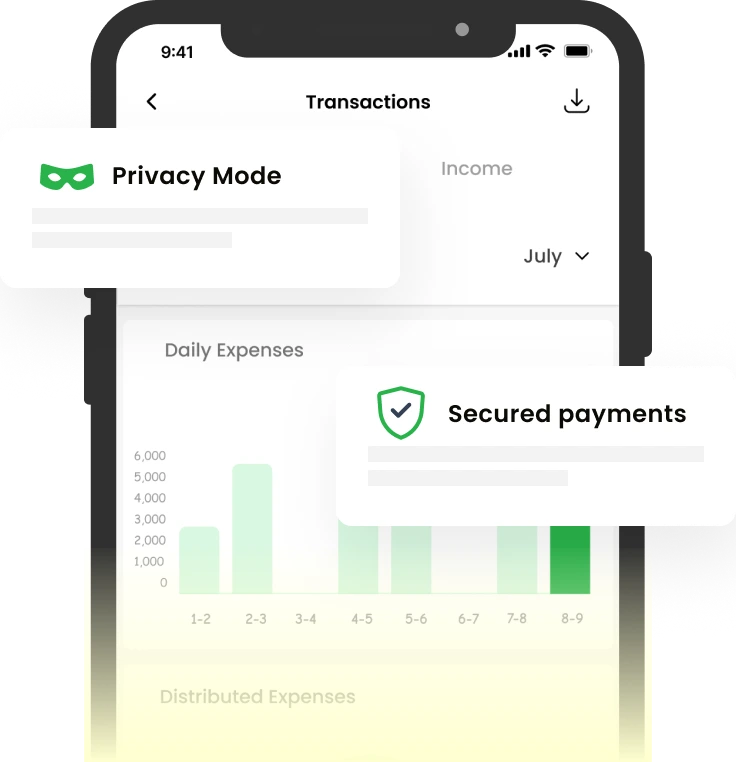

Privacy-Powered Payments

Keep your transactions confidential with our cutting-edge privacy features, giving you peace of mind with every transfer.

Why Lemonade?

Lemonade offers secure payment solutions to receive payments, make transfers, and scale your business.

Responsive Support

Lemonade offers its merchants dedicated account managers ranging from technical to relationship managers

Easy Integration

One API for offline and online payments processing

Licensed and Certified

Lemonade is certified by the highest compliance standards across its operational countries and regions

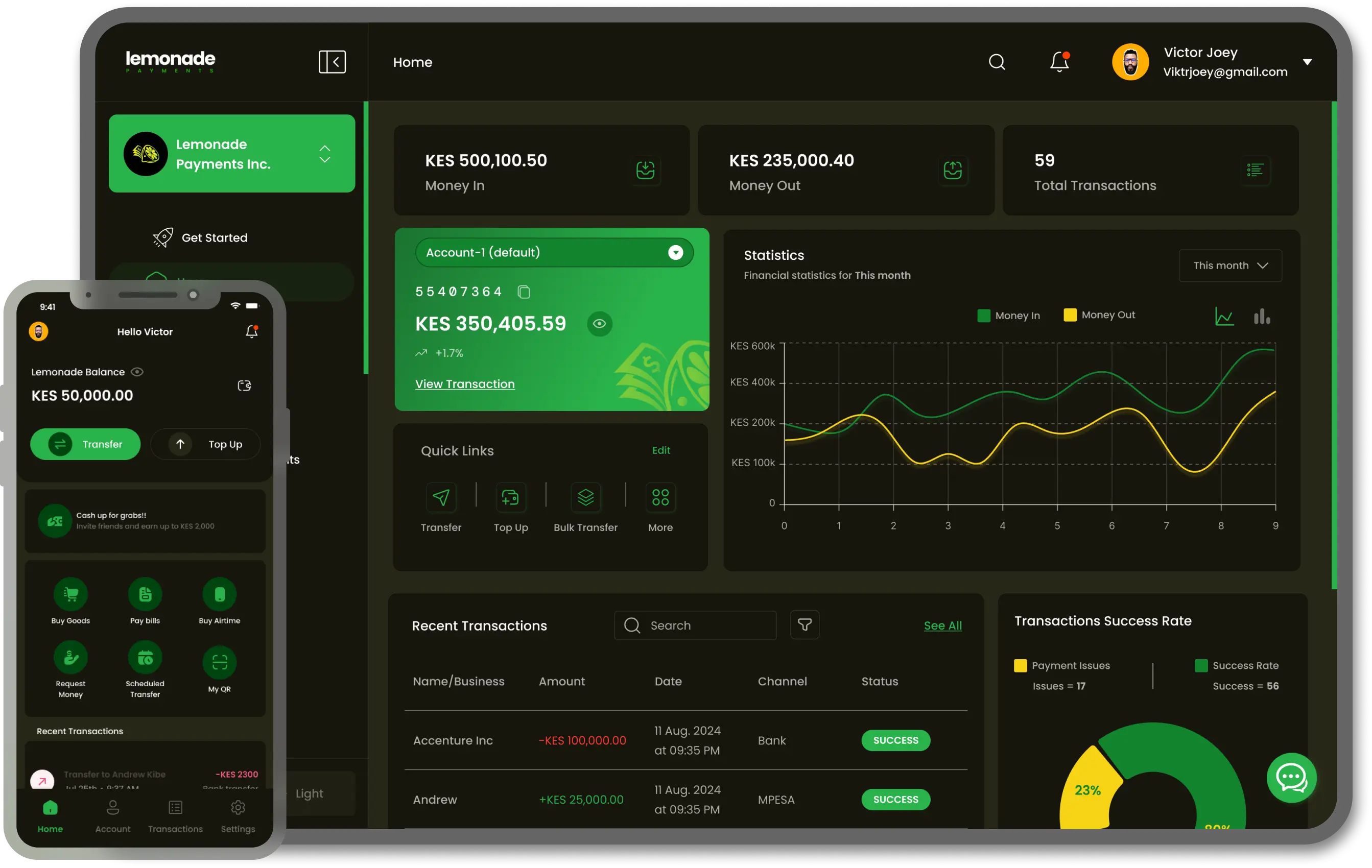

Monitor Your Business

In-depth dashboards and analytics give visibility over every aspect of the payment experience

Continuous Improvement

We’ve done 50 integrations and counting, while we ship features & improvements weekly

Scalable and Reliable

Lemonade systems operate with 99.95% uptime & guarantee scalability as your business grows

Lemonade enables individuals and businesses of all sizes to operate at their highest level.